Nigeria’s Debt Rises By 75% In 3 Months

The Debt Management Office has said Nigeria’s total public debt hit N87.38 trillion at the end of the second quarter of 2023.

The figure represents an increase of 75.29 per cent or N37.53tn compared to N49.85tn recorded at the end of March 2023.

The DMO in a report on Thursday said the debt includes the N22.71tn Ways and Means Advances of the Central Bank of Nigeria to the Federal Government.

The DMO stated, “Nigeria’s total public debt stock as at June 30, 2023, was N87.38tn ($113.42bn). It comprises the total domestic and external debts of the Federal Government of Nigeria, the thirty-six states, and the Federal Capital Territory.

“The major addition to the Public Debt Stock was the inclusion of the N22.712tn securitized FGN’s Ways and Means Advances.”

The statement also noted that other additions to the debt stock were new borrowings by the Federal Government and the sub-nationals from local and external sources.

It added, “The reforms already introduced by the present administration and those that may emerge from the recommendations of the Fiscal Reform and Tax Policies Committee, are expected to impact debt strategy and improve debt sustainability.”

The DMO had earlier projected that Nigeria’s public debt burden may hit N77tn following the National Assembly’s approval of the request by former President Muhammadu Buhari to restructure the CBN’s Ways and Means Advances.

The Ways and Means Advances is a loan facility through which the CBN finances the shortfalls in the government’s budget.

The Director-General of the DMO, Patience Oniha, during a public presentation of the 2023 budget organised by the former Minister of Finance, Budget and National Planning, Dr Zainab Ahmed, noted that the debt would be N70tn without N5tn new borrowing and N2tn promissory notes.

However, the latest data showed that the current debt stock of N87.38tn exceeded the DMO’s projection by N10.38tn.

Further breakdown showed that Nigeria has a total domestic debt of N54.13tn and total external debt of N33.25tn.

While the domestic debt makes up 61.95 per cent of total debt, the external makes up 38.05 per cent.

It was observed that there was a significant increase in both domestic and external debt within three months.

The domestic debt rose by 79.18 per cent from N30.21tn while the external debt rose by 69.28 per cent from N19.64tn in Q1 2023.

In its 2022 Debt Sustainability Analysis Report, the DMO warned that the Federal Government’s projected revenue of N10tn for 2023 could not support fresh borrowings.

According to the office, the projected government’s debt service-to-revenue ratio of 73.5 per cent for 2023 is high and a threat to debt sustainability.

It noted that the government’s current revenue profile could not support higher levels of borrowing.

In a report titled, ‘Report of the Annual National Market Access Country Debt Sustainability Analysis (DSA),’ the debt office said, “The projected FGN Debt Service-to-Revenue ratio at 73.5 per cent for 2023 is high and a threat to debt sustainability.

“It means that the revenue profile cannot support higher levels of borrowing. Attaining a sustainable FGN Debt Service-to-Revenue ratio would require an increase of FGN Revenue from N10.49tn projected in the 2023 Budget to about N15.5tn.”

DMO stated that the government must pay attention to revenue generation by implementing far-reaching revenue mobilisation initiatives and reforms including the Strategic Revenue Growth Initiatives and all its pillars with a view to raising the country’s tax revenue to GDP ratio from about 7 per cent to that of its peer.

The Federal Government would be unable to borrow a lot as it nears its self-imposed debt limit of 40 per cent, the DMO said.

To reduce borrowing and budget deficit, DMO stated that the government should encourage the private sector to fund some of the capital projects that were being financed from borrowing through the public-private partnership schemes.

It added that the Federal Government can reduce borrowing through the privatisation and/or sale of Government assets.

Over the years, Nigeria’s low revenue generation has pushed the government to more borrowing.

However, President Bola Tinubu recently expressed his administration’s commitment to break the cycle of overreliance on borrowing for public spending, and the resultant burden of debt servicing it places on management of limited government revenues.

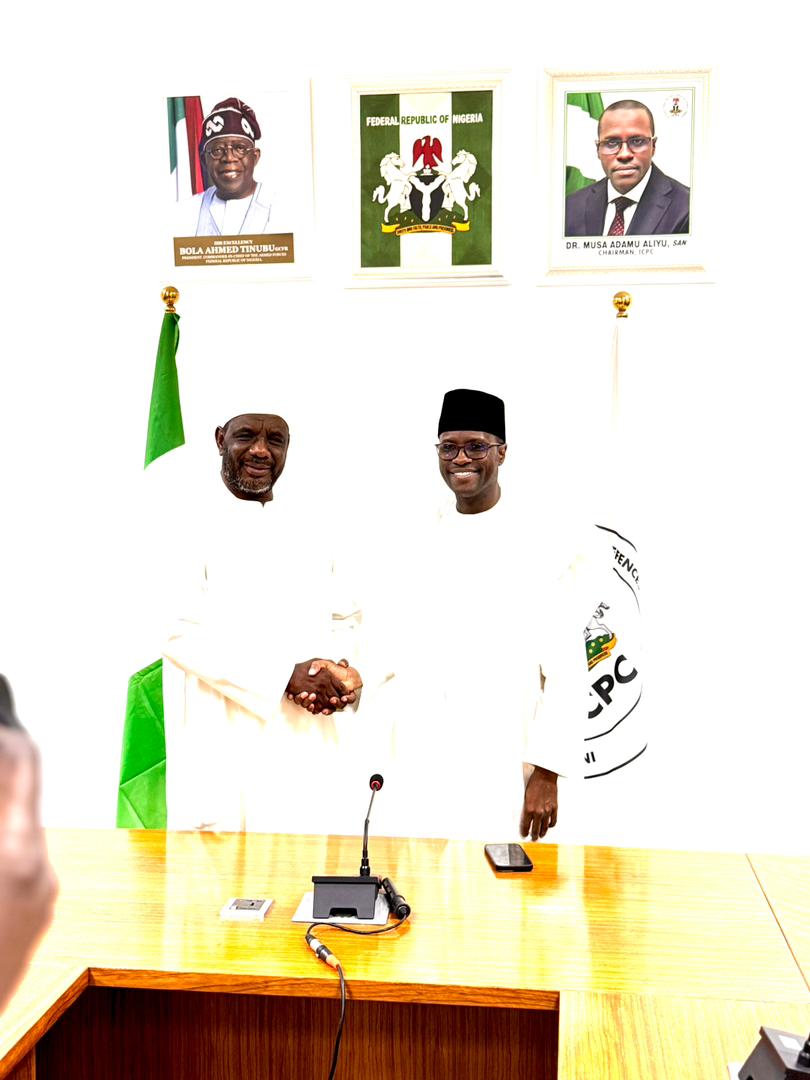

Inaugurating the Presidential Committee on Fiscal Policy and Tax Reforms, chaired by Taiwo Oyedele, the President charged the committee to improve the country’s revenue profile and business environment.

Ways and Means

According to a Monetary Policy Committee member, Adeola Adenikinju, regarding the fiscal sector, both the government revenue and expenditure underperformed between January and May 2023.

In his personal statement released by the Central Bank at the last MPC meeting, he said the FG retained revenue stood at N1.67tn, lower than the pro-rata target of N1.97tn, which was due to the underperformance of FAAC receipts, gross independent revenue.

He said, “In the same vein, total FGN expenditure as of May 2023, was N4.77tn, 27.8 per cent lower than the budget estimate of N6.61tn. The shortfall came mainly from allocation for debt service, interest on Ways and Means, and capital expenditure.”

However, he added that the rise in FAAC overtime would help in managing the recourse of the FG and sub-national units on debts to finance government activities.

“This would also reduce Ways and Means finance and eventually reduce inflationary pressures from the monetary side,” he said.

Naira devaluation

The Deputy-President of the Lagos Chamber of Commerce and Industry, Gabriel Idahosa, blamed the devaluation of the naira as a major factor that increased the public debt, in naira terms.

He further stated that the new administration might have also inherited undisclosed debts which have accumulated to raise the figure to N87tn by the second quarter of the year.

He said, “The foreign exchange conversion will easily move the debt from N37tn to about N64tn. So, before the convergence, the rate was about N460. Now the CBN rate is about N800. So, that is almost double. So, it is not really mysterious.

“The only thing is that there is still a gap, it shouldn’t be up to N87tn unless additional debt was taken. It could be that some debts were not captured until now that the new government is opening the all the books.”